Structured Products – What They Are And Why You Should Consider Investing In Them

Investors and advisers have had to navigate inclement weather in the financial landscape during the past few years. With cash and government securities (gilts) delivering around 4% p.a., bonds and equities volatile, traditional model portfolios aren’t always delivering the outcomes that investors are looking for.

Here we examine the case in favour of Structured Products performing a more significant role in investment portfolios based on reduction in risk and the potential for attractive returns.

So, What Are Structured Products?

Structured Products are pre-packaged investments which provide a defined return based on the performance of an underlying asset linked to interest plus one or more derivatives. These are tailored to the needs of investors and designed for those who want to invest for a fixed period and have a degree of protection over their initial capital. The underlying assets can take the form of a stock market index, currency, commodity, or other derivative and Structured Products are backed by a counterparty, usually an established global financial institution.

Structured Products have specified start and end dates, and each may be applied for during a subscription period, typically around 6 weeks from the launch date to the product start date. Defined returns are achieved provided products are held for the full term.

There are 2 types of Structured Product, being Structured Deposits and Structured Investments and these are described below.

1. Structured Deposits

2. Structured Investments

- Kick-out-products – typically designed to offer the potential for a fixed level of return, for each year that a plan runs, with opportunities for automatic early maturity during the term, if the level of the stock market or other underlying asset has out-performed against benchmark on the kick-out dates, and the specified terms of the product.

- Income products – typically designed to offer either a fixed level of income or alternatively a higher level of conditional income, over a fixed term, that link the repayment of money invested at the end date to the level of the stock market or other underlying asset. Some income products also include a kick-out feature.

- Growth products – typically designed to offer growth potential over a fixed term, linked to stock market or other underlying asset performance. Strategies may include the potential for a fixed return or alternatively a defined participation rate based on the underlying asset performance (that may outperform the benchmark, by contract).

Why You Should Consider Investing In Structured Products

Firstly, what are investors most focused on? We believe that primarily, this will be avoiding capital loss and / or sharp downward movements in their portfolio values. This a typical human behavioural trait, with many investors spending more emotional energy on their anxieties when markets and investment values fall, than on the happiness gained when they rise. However, this kind of behaviour has led to many investors losing composure required for successful investing and panicking by selling investments too early then missing out on future recoveries and gains.

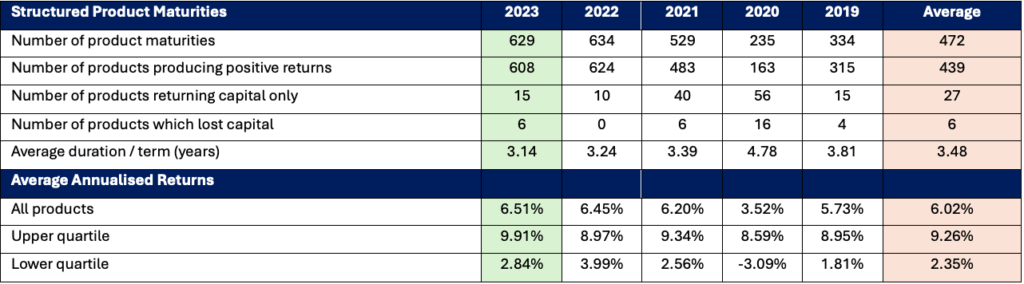

Secondly, why are Structured Products not used more, when they have delivered over a 96% success rate in delivering positive outcomes for investors? The evidence in favour of more mainstream use of Structured Products is illustrated in the tables below*:

Headline Data

Key Takeaways

- UK retail structured products maturing in 2023 delivered an average return of 6.51% p.a. over an average term of 3.14 years. This was the best performing of the last five years.

- Every maturing structured product delivered results exactly in line with the contracted, defined outcomes specified at the outset.

- 66% of maturing plans generated positive returns in 2023 compared with a five-year average of 93%

- Only 0.95% of maturities realised a capital loss in 2023, compared to 1.36% for the five-year average

- Returns are shown net of provider, custody and administration charges, but gross of intermediary fees

*Source: StructuredProductReview.com

Past performance is not a reliable indicator of future performance and should not be used to assess the future returns or risks.

Another key benefit of Structured Products to individual investors is that they may be invested using tax wrappers, including an Individual Savings Account (ISA); Self Invested Personal Pension (SIPP) and Small Self-Administered Scheme (SSAS), meaning that tax-free gains can be achieved.

In Summary

Based on the data shown in the tables and the likelihood of falling interest rates in the short to medium term, we believe that there is a strong argument in favour of the use of Structured Products as an alternative to cash-based alternatives such as bank & building society accounts and fixed rate bonds. By dealing with an established financial adviser, who is experienced in the Structured Products market, adding value by selecting the most appropriate plans which achieve upper quartile performance is very attainable.

By way of further information, please take a look at a few short educational videos compiled by UK Structured Products Association. These can be accessed through the following link:

Get In Touch Today

At Best Advice Wealth Management, we are fully regulated and very active in arranging Structured Products for our clients. We believe that they provide an excellent opportunity to make a compelling addition to a modern, balanced, risk-managed portfolio.

We invite you to get in touch with us to discuss how Structured Products may benefit you.