View the latest Structured Deposit and Structured Investment plans from the UK's best providers

Quality Structured Deposits and Structured Investment Plans

We can support you on your wealth management journey by supplementing your investment portfolio with structured products solutions.

- Structured Products typically offer a higher return than a standard deposit.

- We offer a full range of available products through all the main UK providers and plans are suitable for both private and corporate investment.

- We have been endorsed as reputable Structured Products providers by leading financial journalist David Stevenson (Financial Times, Citywire, MoneyWeek).

- We believe that our fees are the lowest in the UK.

- All plans are backed by global financial institutions as counterparties.

- Simple to arrange on an advised or non-advised basis, depending on the provider’s requirements and your own needs.

What Are Structured Products?

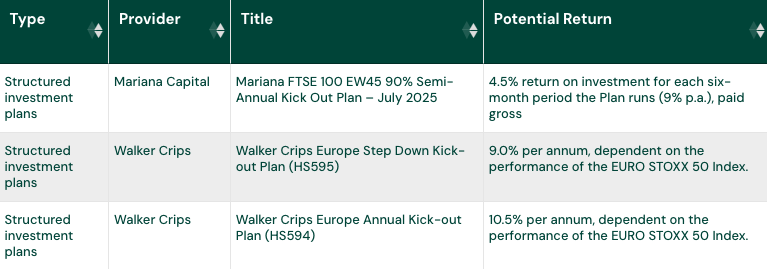

There are 2 kinds of Structured Product investments. These are Structured Deposit Plans and Structured Investment Plans and are summarised below:

Structured Deposit Plans

Structured Investment Plans

Featured Structured Product Providers

Hilbert Issuer Counterparty Dataset Reports

Advised Or Non-Advised? Lowest Fees

We believe that our fees for arranging Structured Products are the lowest in the UK.

Non-advised structured investments are lower risk, straightforward, affordable and easy to arrange for a fee of 0.5% per investment (subject to a minimum fee of £75).

For longer term, higher risk products and / or where the provider requires advice to be provided, we will spend time advising you and assessing your risk profile for a fee of 1.5% of the invested capital, (subject to the minimum advice fee of £300).

However, if an investor wants to talk through a non-advised product we can offer our advisory service, subject to a fee.

Don’t Forget The Risks

All investments carry risk. It is identifying those risks, understanding how they may affect an investment and assessing whether an investment is suitable for your circumstances that is important.

The potential returns of most structured products and repaying the money invested are usually linked to the level of a stock market index and also depend on the financial stability of the issuer and counterparty bank. You should only consider investing if you understand and accept the risk of losing some or all of any money invested.

You should always read the relevant plan brochure and any other plan documentation, for full details of a plan’s features, including any risks, and the terms and conditions. In addition to the plan brochure and terms and conditions there are other important documents, including a Key Information Document (‘KID’), that you should consider, before deciding to invest in a plan.

Structured products should only be considered as part of a diversified and balanced portfolio.

Below is a summary of some of the main risks usually associated with an investment in structured product plans:

Whether or not a plan generates the potential returns for investors usually depends on the closing level of the relevant index on the relevant dates for the plan, i.e. the kick-out anniversary dates for kick-out products; the early maturity dates and end dates for growth products; the annual income dates for income products.

If the index closes below the level needed, for the plan or plan options chosen, on all of the relevant dates, the plan or plan options will not generate a return.

Some structured product plans are designed so that they are 100% protected from stock market risk at the end date.

It is important to understand that even if a structured product plan is designed with 100% protection from stock market risk, at the end date, it will still usually have issuer and counterparty bank risk. In other words, both the potential returns of the plan and repaying the money invested at the end date will depend on the financial stability of the issuer and counterparty bank. If the issuer and counterparty bank become insolvent, or similar, or fail to be able to meet their obligations, it is likely that investors will receive back less than they invested.

If the closing level of the relevant index is below the level needed on all of the kick-out anniversary dates or early maturity dates, if relevant for the plan or plan options chosen, and on the end date, repaying the money invested at maturity will usually depend on the closing level of the index on the end date..

Different structured products use different types of protection barriers. Some products use barriers that are observed every day that can therefore be breached on any day during the investment term, while some products use barriers that are only observed at the end of the investment term and that cannot therefore be breached during the investment term.

Market risk to the repayment of money invested on the end date will depend on the type of barrier and its level.

For example, for a product with an end of term barrier, set at 60% of the start level, if the index for the plan closes at or above 60% of the start level, on the end date, money invested will be repaid in full (less any agreed adviser fees and withdrawals). However, if on the end date the index closes below 60% of the start level, the amount of money repaid (less any agreed adviser fees and withdrawals) will be reduced by the amount that the index has fallen. For example, if the index has fallen by 45%, the repayment of money invested will be reduced by 45% (meaning that investors will get 55% of their investment back).

Both the potential returns and repaying the money invested of most structured products depend on the financial stability of the issuer and counterparty bank. If the issuer and counterparty bank become insolvent, or similar, or fail to be able to meet their obligations, it is likely that investors will receive back less than they invested.

Structured Deposit Plans are deposit-based and will usually be fully protected from stock market risk at the end date and will also benefit from the protection of the Financial Services Compensation Scheme (FSCS), if the counterparty bank or financial institution is a licensed UK deposit taker.

For Structured Investment Plans, it is important to understand that investors do not have the protection of the Financial Services Compensation Scheme (FSCS) and could lose money if performance of the underlying index or asset fails to meet the required benchmark of if the plan provider or deposit-taking counterparty, typically an established global bank, fails.