Shield Your Wealth from Inheritance Tax in Just 2 Years, using a Business Relief Investment

Slash Inheritance Tax in Just 2 Years, Without Losing Control of Your Wealth

Inheritance Tax can take a big chunk of your legacy. With Business Relief, you can keep more of your wealth where it belongs – with your family.

- Anyone can qualify, subject to financial advice.

- You don’t need to own a business to benefit.

- Investments can become Inheritance Tax exempt in just two years

Unlike gifts or trusts, you stay in full control of your investment.

Find out if a Business Relief Investment is right for you.

How Business Relief Can Reduce Your Inheritance Tax Bill

Who Is It For?

What Are The Benefits?

How Does It Work?

Invest in a qualifying business, and two years later, it becomes IHT-exempt.

Unlock The Benefits Of Business Relief Investment

Pass on your wealth to the next generation without the heavy burden of Inheritance Tax. Investments can become tax-exempt just 2 years after initial investment and be a useful Estate Planning strategy when time is of the essence.

Business Relief (BR) products invest in a variety of non-listed or AIM listed businesses. Managers of BR products typically prioritise investing in companies with established, secure income streams. An investment in a BR qualifying business can be an effective way of giving your inheritance the opportunity to grow for those who will benefit from it. Many BR investments provide access to sustainable sectors, such as renewable energy generation or forestry, which means clients can choose to leave a financial legacy for future generations whilst their investment creates a positive impact during their lifetime.

BR investments can also help the very elderly or people in poor health who have not made any provision for Inheritance Tax planning and may otherwise feel they have left it too late.

Protect Your Legacy

We’ll help you to invest in a non-listed or AIM-listed business with an established, secure income stream, and you’ll keep ownership and control over your assets.

Wide Product Selection

We’re fully regulated, offering a full choice of BR products through all main UK-recognised providers on an advised basis only, unlike some distributors who provide limited options on a non-advised basis.

Lowest Advice Fees

We’re confident that our BR fees are the UK’s lowest, at only 1% of the amount invested (minimum £300), plus provider fees which are typically 2%-3% upfront.

See The Difference: Business Relief In Action

Inheritance Tax used to be considered a tax payable only by the wealthy. However, after decades of rising house prices, an increasing number of people are faced with an IHT liability. This is even after an increase to £175,000 in the main residence nil-rate band, which is used alongside each individual’s nil-rate band of £325,000, currently fixed until April 2030. From April 2027, pensions passed on will also be subject to Inheritance Tax as announced by the Chancellor in her 2024 Autumn Budget; a significant change which will make many more estates liable to pay IHT. Inheritance tax is payable by the deceased’s beneficiaries.

Inheritance Tax relief is currently applied on the full amount of Business Relief investments (at November 2024) whether held in non-listed shares or AIM-listed shares. From 6th April 2026, however, there will be a distinct difference in IHT Relief for non-listed shares vs AIM-listed. For non-listed shares, investors will have a maximum of £1million that can still benefit from 100% IHT relief. Any amount exceeding £1million will have reduced relief of 50%. For AIM-listed shares, there’s no £1million “allowance” – any amount at all invested in these shares will only receive 50% relief maximum.

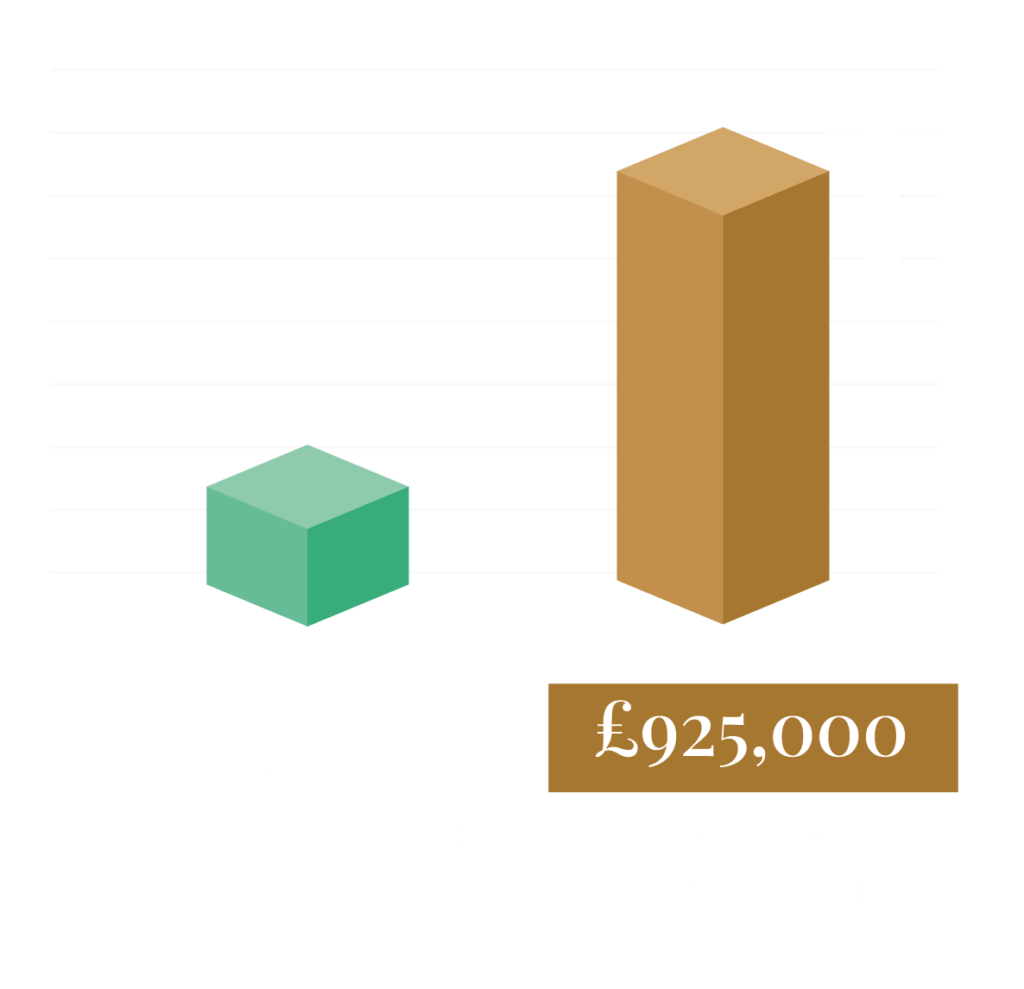

An example of how a Business Relief investment works in practice is shown below:

- Jordan has an estate valued at £925,000 including property, cash and investments.

- The value of his estate above his individual nil-rate band (£325,000) and residential nil-rate band (£175,000) is £425,000.

- His current IHT liability is £425,000 x 40% so £170,000.

- However, if Jordan invests £425,000 into a BR-qualifying investment*, there would be no IHT payable, provided the investment has been held for a minimum of 2 years at the time of death.

- As a result, Jordan’s beneficiaries would inherit the full value of his estate of £925,000 and would not need to pay an IHT bill of £170,000 based on his current circumstances. His estate would be passed down intact to the next generation.

*From 6th April 2026, full IHT tax relief up to £1Million is only available when investing in a private, unlisted company. If investing in an AIM listed company from this date, then IHT relief would be 50%

Ready To Slash Your Inheritance Tax?

Don’t be part of a statistic. Discover how Business Relief can protect your wealth and your family’s inheritance. Fill out the form for a free consultation and tailor your strategy today.

Why Choose Us For Your Business Relief Needs?

At Best Advice, we understand that trust and personal attention form the cornerstone of any lasting partnership. Discover how our dedicated approach to your financial needs can transform your future.

Personalised Relationships

We prioritise regular communication to align closely with your goals over time.

Independent Advice

Receive bespoke advice tailored specifically to your financial needs.

Free Initial Consultation

Start with no commitment and see the value we offer firsthand.

30+ Years of Experience

Benefit from decades of expertise in financial planning and wealth management.

Comprehensive Financial Services

We’re fully independent financial health experts, providing advice from Business Relief to a comprehensive range of wealth management and financial planning services.

Frequently Asked Questions About Business Relief

BR is a tax relief in the UK that can reduce or eliminate Inheritance Tax payable by investing in business assets.

BR products invest in a variety of non-listed or AIM listed businesses with established, secure income streams.

The investor retains ownership of their money and, unlike trusts and gifts, which can take seven years to obtain 100% IHT relief, BR-qualifying investments are exempt when held for a minimum of just two years and at time of death.

BR products are high-risk investments which invest in smaller, unlisted, or AIM-listed companies. Investments in unquoted companies or those quoted on AIM can fall or rise more sharply than shares in larger companies listed on the main market of the London Stock Exchange, and may be harder to sell, so you may lose your capital.

Consequently, BR providers usually insist on investors taking advice from a regulated professional adviser to ensure suitability of their investment. There are a few distributors who offer BR products on a non-advised basis, but these will only offer a few products. At Best Advice Wealth Management, we can add value by giving you access to a much wider choice, as we offer BR investments on an advised basis only and through ALL of the main UK recognised providers.

Anybody can benefit from BR by making an investment in a BR-qualifying business.

If you’re a business owner, a partner in a firm, or hold shares in a private company, you might also be eligible for BR.

Any assets must have been held for at least two years at the time of the investor’s death before they can qualify.

You can get 100% Business Relief* on:

- A business or interest in a business

- Shares in an unlisted company

You can get 50% Business Relief* on:

- Shares controlling more than 50% of the voting rights in a listed company

- Land, buildings or machinery owned by the deceased and used in a business they were a partner in or controlled

- Land, buildings or machinery used in the business and held in a trust that it has the right to benefit from

*Inheritance Tax relief is currently applied on the full amount of Business Relief investments (at November 2024). From 6th April 2026, IHT relief will be applied in full for BR investments in non-AIM listed companies on the first £1 Million and 50% relief will be applied to any amounts invested over £1 Million. For BR investments in AIM shares after 6th April 2026, IHT relief will be applied at 50% on any amount invested.

If you have a potential Inheritance Tax liability and wish to pass on as much of your wealth as possible, you should consider an investment in a BR product as a solution.

We strongly recommend consulting with a specialist who can provide personalised advice on this complex subject, based on your specific circumstances. We are here to help you.

Ready To Start?

Take the first step towards protecting your wealth today. Complete the form below to schedule your complimentary consultation with one of our BR experts.