Minimum investment amount £5000

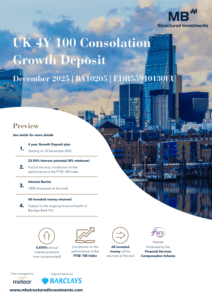

The MB Structured Investments UK 4Y 100 Consolation Growth Deposit December 2025 – BA10205 plan is a maximum 4 year 3 weeks investment offering 23.50% Interest potential (5.875%pa)

Important: The closing date for applications by cheque is 04 December 2025 and by bank transfer is 08 December 2025.

The closing date for ISA transfer applications is 19 November 2025.

Product Literature And Forms

You should always read the relevant plan brochure and any other plan documentation, for full details of the plan’s features, including any risks, and the terms and conditions. In addition to the plan brochure and terms and conditions, there are other important documents, including a Key Information Document (‘KID’), that you should consider before deciding to invest in the plan.

If you do not fully understand the risks or are unsure as to the suitability of the investment, please contact us

How To Invest?

Applications for the Plan must be submitted via Best Price Financial Services and received by 5pm on 08 December 2025 for bank transfer applications.

The closing date for applications by cheque is 04 December 2025

The closing date for ISA transfer applications is 19 November 2025.

This will enable us to process your application and forward it on to the structured product provider.

1. Firstly, print off and complete our Appropriate Assessment Questionnaire. All applications require two proofs of identity – see the questionnaire for more information.

2. Next download, print and complete the application form available. Note that product applications will have multiple documents, so please choose the one relevant to you.

3.Place all completed documents – questionnaire, proofs of identity, application form and cheques for payment – in an envelope and post to:

Best Price Financial Services,

The Tythe Barn, 5 Eglwys Nunnydd,

Margam, Neath Port Talbot

SA13 2PS

Further Information

The MB Structured Investments UK 4Y 100 Consolation Growth Deposit December 2025 – BA10205 plan is a maximum 4 year 3 weeks investment offering 23.50% Interest potential (5.875%pa)

Investment Return: The plan starts on the Start Date. At the End Date, if the End Level of the Index is at or above 100% of its Start Level, the plan will end and pay the Maximum Interest equal to 23.50% of the money invested. This barrier level is called the Interest Barrier. Otherwise, at the End Date, the plan will end and pay the Minimum Interest equal to 8% of the money invested.

Interest Barrier: 100% (measured at the end)

Potential Interest: 23.50% paid at the end (8% minimum)

Capital Return: Customers will get all their invested money back at the End Date regardless of the performance of the Index.

About Barclays Bank PLC: The underlying financial contracts in this plan are manufactured by an investment bank. Because they are ultimately responsible for any payment obligations such as any money made from the plan and the repayment of invested money, they are considered the Counterparty.

More specifically, the Counterparty to this plan is Barclays Bank PLC in its capacity as deposit taker.

The financial contracts are formed by depositing your money with Barclays Bank PLC, through a bare trust. A bare trust is an arrangement which allows us to act on your behalf in relation to your plan. The deposit effectively loans your money to the Counterparty, entitling you to the features of this plan.

What Are The Risks Of The Plan?

As with all forms of investment there are risks involved.

You must be prepared to leave your deposit invested for the full fixed term otherwise you may get back less than you put in

A standard cash deposit account will repay your deposit in full, regardless of when you withdraw. Structured deposits are different because their value during the fixed term depends on many factors including interest rates, the creditworthiness of the deposit-taker and any ups and downs in the value of the underlying asset or index to which the return is linked. You will get your money back plus the potential returns if you hold your deposit until maturity, but the amount you would get back if you needed to withdraw early may vary significantly and some structured deposit providers may also charge an exit fee for early withdrawal.

There is a risk that you will receive no return on your deposit

For example, if you are promised a return linked to how the stock market performs, and it falls during the fixed term, then your return could be zero (assuming there is no minimum return) so you will just get back your deposit. You must be comfortable that this is a risk you are willing to take, and that receiving no return at all would not cause you financial difficulties. You should also understand how returns are calculated over the period of the product and whether this is based on specific points in time or averaged over the whole term of the deposit.

Inflation could erode the value of your deposit

Inflation is the rise in the price of goods and services over time. It means that your money will be able to buy less in the future than it does today. If you were to put money in a structured deposit and there was high inflation over the fixed term, your deposit at the end of the term would be worth less than it was at the start of the term. Of course, this risk also applies to any savings or investment product that is not inflation-linked.

There are limits on how much you can claim under the Financial Services Compensation Scheme

Structured deposit plans are deposit-based and will usually be fully protected from stock market risk at the end date and benefit from the protection of the Financial Services Compensation Scheme, if the counterparty is a licensed UK deposit taker. The Financial Services Compensation Scheme (FSCS) is the UK’s deposit guarantee scheme. This provides for compensation of up to £85,000 per UK-eligible individual claimant per institution in the event of failure of the counterparty bank or institution for the aggregated amount of all eligible deposits held with them. Please refer to the individual plan brochure for details.